Options data indicates short covering

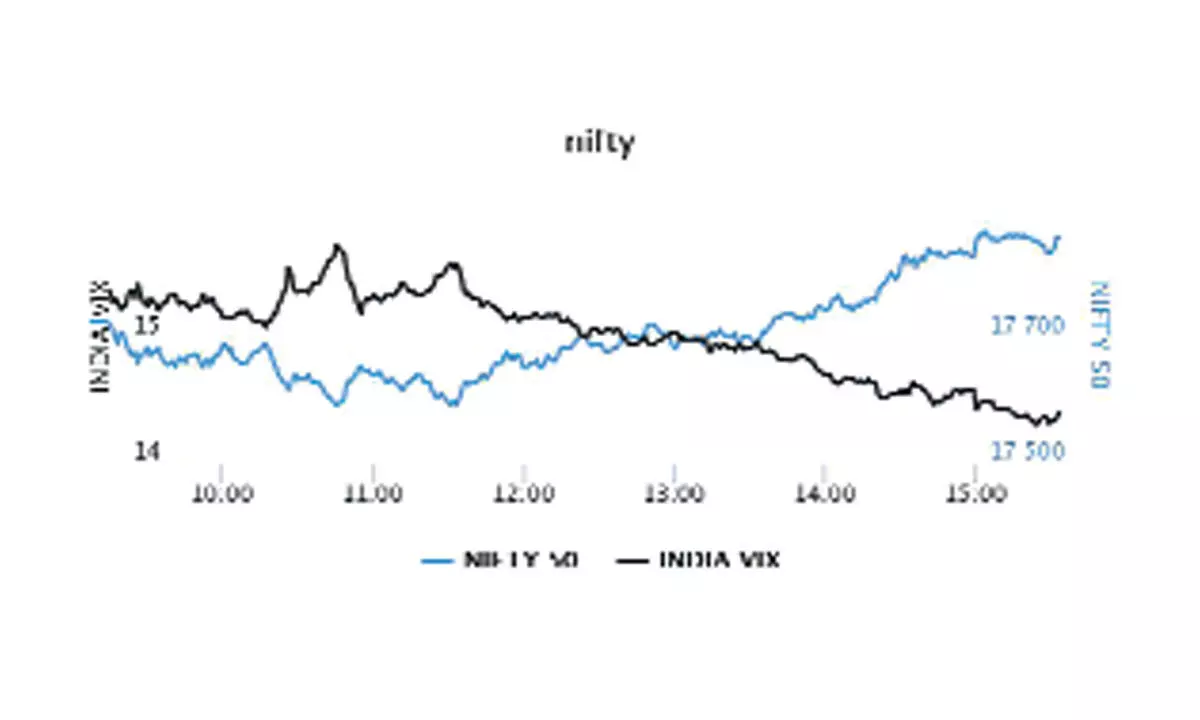

Friday’s closing suggests recovery extension considering huge short positions prevailing in Nifty; Net shorts by FIIs are over 1.1 lakh contracts; India VIX fell 8.52% to 14.39 level

image for illustrative purpose

Heavy Call writing at 17,800 and 18,000 strikes with almost one crore shares (weekly and monthly) may trigger recovery process towards 18,200 level in the week ahead. The 18,000CE has the highest Call OI followed by 18,500/ 18,200/ 17,600/17,800/17,900 strikes. Further, 18,200/18,300/18,100/18,350 strikes recorded reasonable addition of Call OI.

Coming to the Put side, maximum Put OI is seen at 17,600/17,700/17,500/ 16,100/17,000/17,300 strikes, while 17,700/17,600/17,500/17,000/16,900 strikes witnessed significant build-up of Put OI.

Dhirender Singh Bisht, senior research analyst (derivatives) at SMC Global Securities Ltd, said: "From the derivatives front, Nifty's highest Call Open Interest concentration is seen at 18000 strike whereas on Put side, the highest concentration is at 17600 strike along with marginal OI addition seen in 17700 and 17500 strikes as well."

The Put options data points to support at lower levels near 17500 and last Friday's closing suggests recovery extension considering huge short positions prevailing in the index. Net shorts by FIIs are more than 1.1 lakh contracts and historically they have bottomed out near 1.2 lakh contracts. Hence, more short covering deals are likely.

"In the week gone, the Nifty slipped sharply lower on opening note, but somehow managed to recover most of its losses during the later part of the week and closed in the green zone after sharp short covering seen in Adani Group. On a weekly basis, sectors like auto and FMCG took a lead, while oil & gas along with metal stock remained laggard," added Bisht.

BSE Sensex closed the week ended February 3, 2023, at 60,841.88 points, a recovery of 1,510.98 points or 2.54 per cent, from the previous week's (January 27) closing of 59,330.90 points. NSE Nifty ended the week at 17,854.05 points, a modest rebound of 249.70 points or 0.14 per cent, from 17,604.35 points a week ago.

Bisht forecasts: "Technically, Nifty has managed to take support at its 200-days exponential moving average on daily charts and made a strong comeback in the later part of the week. For the upcoming sessions, we expect that markets are likely to remain on a volatile path with the 18000-18100 zone as a strong resistance zone for the index."

India VIX fell 8.52 per cent to 14.39 level. Post-Budget Indian VIX declined considerably below 15 level despite large index moves. The Nifty is trying to form some base near 17500 level. Since most results from index heavyweights are out along with the crucial events, markets may stabilise near current level and further acceleration is likely if the Nifty sustains above 17800 mark.

"Implied Volatility (IV) of Calls closed at 14.91 per cent, while that for Put options closed at 15.62 per cent. The Nifty VIX for the week closed at 15.73 per cent. PCR of OI for the week closed at 1.10 lower from the previous week," observed Bisht.

Bank Nifty

NSE's banking index closed the week at 41,499.70 points, higher by 1,154.40 points or 0.31 per cent from the previous week's closing of 40,345.30 points. Bank Nifty closed near its highest Call OI base of 41500. If the banking index sustains above this level, then a leg of short covering to pan out can be expected. Despite a sharp sell-off, the volatility is still hovering below the 17 per cent mark, which is a positive development. Hence, analysts rule out any major selling from here. On the upside, the Bank Nifty may test 42500 level.